UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement | |||

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |||

| ☒ | Definitive Proxy Statement | |||

| ☐ | Definitive Additional Materials | |||

| ☐ | Soliciting Material Pursuant to§240.14a-12 | |||

Fortune Brands Home & Security, Inc. | ||||

| (Name of Registrant as Specified In Its Charter) | ||||

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) | ||||

| Payment of Filing Fee (Check the appropriate box): | ||||

| ☒ | No fee required. | |||

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies:

| |||

| ||||

| (2) | Aggregate number of securities to which transaction applies:

| |||

| ||||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

| |||

| ||||

| (4) | Proposed maximum aggregate value of transaction:

| |||

| ||||

| (5) | Total fee paid: | |||

| ||||

| ☐ | Fee paid previously with preliminary materials. | |||

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) | Amount Previously Paid:

| |||

| ||||

| (2) | Form, Schedule or Registration Statement No.:

| |||

| ||||

| (3) | Filing Party:

| |||

| ||||

| (4) | Date Filed:

| |||

| ||||

520 Lake Cook Road, Deerfield, Illinois 60015

NOTICE OF ANNUAL MEETING

AND PROXY STATEMENT

March 7, 201714, 2018

Dear Fellow Stockholders:

We are pleased to invite you to the 20172018 Annual Meeting of Stockholders (“Annual Meeting”) of Fortune Brands Home & Security, Inc. on Tuesday, May 2, 20171, 2018 at 8:00 a.m. (CDT) at the Renaissance Chicago North Shore Hotel, 933 Skokie Boulevard, Northbrook, Illinois. The following matters will be considered at the Annual Meeting:

| Proposal 1: | ||

| Proposal 2: | ||

| Proposal 3: | ||

| Proposal 4: | Advisory vote to approve the frequency of voting on the compensation paid to the Company’s named executive officers (see page | |

such other business as may properly come before the Annual Meeting.

Stockholders of record at the close of business on March 3, 2017,2, 2018, the record date for the Annual Meeting, are entitled to vote.Stockholders who wish to attend the Annual Meeting in person should review the instructions beginning on page 1.

YOUR VOTE IS VERY IMPORTANT. WHETHER OR NOT YOU PLAN TO ATTEND THE ANNUAL MEETING, PLEASE SUBMIT YOUR PROXY OR VOTING INSTRUCTIONS AS SOON AS POSSIBLE. See pages1-41-5 for voting instructions.

This Proxy Statement and accompanying proxy are first being distributed on or about March 14, 2017.2018.

|

| Robert K. Biggart |

| Senior Vice President, General Counsel and Secretary |

Important Notice Regarding the Availability of Proxy Materials

for the 20172018 Annual Meeting of Stockholders to be Held on Tuesday, May 2, 2017.1, 2018.

This Notice of Annual Meeting and Proxy Statement and the Annual Report on Form10-K for the fiscal year ended December 31, 20162017 (“Form10-K”) are available atwww.proxyvote.comwww.proxyvote.com.

| 1 | ||||

Compensation Committee Interlocks | ||||

| 26 | ||||

| 33 | ||||

| 34 | ||||

| 35 | |||

| 37 | ||||

| 39 | ||||

| 40 | ||||

| 42 | ||||

| 43 | ||||

PROPOSAL 2 – RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | ||||

PROPOSAL 3 – ADVISORY VOTE ON NAMED EXECUTIVE OFFICER COMPENSATION | ||||

PROPOSAL 4 – ADVISORY VOTE ON THE FREQUENCY OF VOTING ON NAMED EXECUTIVE OFFICER COMPENSATION | 47 | |||

| A-1 |

Why did I receive these materials?

These materials were provided to you in connection with the solicitation by the Board of Directors (the “Board”) of Fortune Brands Home & Security, Inc. (“Fortune Brands” or the “Company”), of proxies to be voted at our Annual Meeting and at any adjournment or postponement of the Annual Meeting. The Annual Meeting will take place on May 2, 20171, 2018 at 8:00 a.m.00a.m. (CDT) at the Renaissance Chicago North Shore Hotel, 933 Skokie Boulevard, Northbrook, Illinois. This Proxy Statement describes the matters on which you, as a stockholder, are entitled to vote and gives you the information that you need to make an informed decision on these matters.

Why did I receive a “Notice of Internet Availability of Proxy Materials” instead of printed proxy materials?

Companies are permitted to provide stockholders with access to proxy materials over the Internet instead of mailing a printed copy. WeUnless we were instructed otherwise, we mailed a Notice of Internet Availability of Proxy Materials (the “Notice”) to most stockholders. The Notice contains instructions on how to access the proxy materials on the Internet, how to vote and how to request a printed set of proxy materials. This approach reduces the environmental impact and our costs of printing and distributing the proxy materials, while providing a convenient method of accessing the materials and voting.

The Company will make its Annual Report on Form10-K for the last fiscal year, including any financial statements or schedules, available to stockholders without charge, upon written request to the Secretary, Fortune Brands Home & Security, Inc., 520 Lake Cook Road, Deerfield, Illinois 60015. The Company will furnish exhibits to Form10-K to each stockholder requesting them upon payment of a $.10 per page fee to cover the Company’s cost.

Can I get electronic access to the proxy materials if I received printed materials?

Yes. If you received printed proxy materials, you can also access them online atwww.proxyvote.combefore voting your shares. The Company’s proxy materials are also available on our website athttp://ir.fbhs.com/annuals-proxies.cfm. Stockholders are encouraged to elect to receive future proxy materials electronically. If you opt to receive our future proxy materials electronically, you will receive an email next year with instructions containing a link to view those proxy materials and a link to the proxy voting website. Your election to receive proxy materials by email will remain in effect until you terminate it or for as long as the email address provided by you is valid. Stockholders of record who wish to participate can enroll athttp://enroll.icsdelivery.com/fbhs. If your shares are held in an account by a bank, broker or other nominees, you should check with your bank, broker or other nominee regarding the availability of this service.

What is the difference between being a stockholder of record and a beneficial owner?

If your shares are registered directly in your name with Wells Fargo ShareownerEQ Shareholder Services, the Company’s transfer agent, you are the “stockholder of record.” If your shares are held in an account by a bank, broker or other nominee, you hold your shares in “street name” and are a “beneficial owner” of those shares. The majority of stockholders are beneficial owners. For such shares, a bank, broker or other nominee is considered the stockholder of record for purposes of voting at the Annual Meeting. Beneficial owners have the right to direct their bank, broker or other nominee on how to vote the shares held in their account by using the voting instructions provided by the bank, broker or other nominee.

Who is entitled to vote?

Only stockholders who owned the Company’s common stock of record at the close of business on March 3, 20172, 2018 (the “Record Date”) are entitled to vote. Each holder of common stock is entitled to one vote per share. There were 153,504,413148,018,012 shares of common stock outstanding on the Record Date.

FREQUENTLY ASKED QUESTIONS (CONTINUED)

Who can attend the Annual Meeting?

Only stockholders who owned Fortune Brands’ common stock as of the close of business on the Record Date, or their authorized representatives, may attend the Annual Meeting. At the entrance to the meeting, stockholders will be asked to present valid photo identification to determine if you owned common stock ownership on the Record Date. If you are acting as a proxy, you will need to submit a valid written legal proxy signed by the owner of the common stock.You must bring such evidence with you to be admitted to the Annual Meeting.

Stockholders who own their shares in “street name” will be required to submit proof of ownership at the entrance to the meeting. Either your voting instruction card or brokerage statement reflecting your stock ownership as of the Record Date may be used as proof of ownership.

What matters will be voted on at the Annual Meeting?

ThreeFour matters will be considered at the Annual Meeting, which are:

| • |

|

| • |

|

| • | advisory vote to approve the compensation paid to the Company’s named executive officers(Proposal 3); and |

| • |

|

How do I vote?

If you received a Notice in the mail, you can either vote by (i) Internet (www.proxyvote.com) or (ii) in person at the Annual Meeting. Voting instructions are provided on the Notice. You may also request to receive printed proxy materials in the mail.

Stockholders who received printed proxy materials in the mail can vote by (i) filling out the proxy card and returning it in the postage paid return envelope, (ii) telephone(800-690-6903), (iii) Internet (www.proxyvote.com), or (iv) in person at the Annual Meeting. Voting instructions are provided on the proxy card.

Stockholders who received proxy materials electronically can vote by (i) Internet (www.proxyvote.com), (ii) telephone(800-690-6903), or (iii) in person at the Annual Meeting.

If you are not the stockholder of record, but are a beneficial owner of our shares, you must vote by giving instructions to your bank, broker or other nominee. You should follow the voting instructions on the form that you receive from your bank, broker or other nominee, which will include details on available voting methods.To be able to vote in person at the Annual Meeting, you must obtain a legal proxy from your bank, broker or other nominee in advance and present it to the Inspector of Election with your completed ballot at the Annual Meeting.

How will my proxy be voted?

Your proxy card, when properly signed and returned to us, or processed by telephone or via the Internet, and not revoked, will be voted in accordance with your instructions. If any matter is properly presented other than the threefour proposals described above, the Proxy Committee (the persons named in the enclosed proxy card or, if applicable, their substitutes),substitutes, will have discretion to vote your shares in their best judgment.

FREQUENTLY ASKED QUESTIONS (CONTINUED)

What if I don’t mark the boxes on my proxy or voting instruction card?

Unless you give other instructions on your proxy card or your voting instruction card, or unless you give other instructions when you cast your vote by telephone or the Internet, the Proxy Committeepersons named in the enclosed proxy card will vote your shares in accordance with the recommendations of the Board, which areFORthe election of each director named in Proposal 1,FORProposals 1, 2 and 3.

3 andFREQUENTLY ASKED QUESTIONS (CONTINUED)ONE YEAR for the frequency of the advisory vote to approve the compensation of the Company’s named executive officers (Proposal 4).

If you hold shares beneficially and you have not provided voting instructions, your bank, broker or other nominee is only permitted to use its discretion and vote your shares on certain routine matters (Proposal 2). If you have not provided voting instructions to your bank, broker or other nominee onnon-routine matters (Proposals 1, 3 and 3)4), your bank, broker or other nominee is not permitted to use discretion and vote your shares.Therefore, we urge you to give voting instructions to your bank, broker or other nominee on all threefour proposals.Shares that are not permitted to be voted by your bank, broker or other nominee with respect to any matter are called “brokernon-votes.” Brokernon-votes are not considered votes for or against a proposal and will have no direct impact.impact on the voting results, but will be counted for the purposes of establishing a quorum at the Annual Meeting.

How many votes are needed to approve a proposal?

The nominees for director, innon-contested elections, must receive a majority of the votes cast at the Annual Meeting, in person or by proxy, to be elected. A proxy card marked to abstain on the election of a director and any brokernon-votes will not be counted as a vote cast with respect to that director.

Under the Company’s majority vote Bylaw provision relating to the election of directors, if the number of votes cast “for” a director nominee does not exceed the number of votes cast “against” the director nominee, then the director must tender his or her resignation from the Board promptly after the certification of the stockholder vote. The Board (excluding the nominee in question) will decide within 90 days of that certification, through a process managed by the Nominating and Corporate Governance Committee, whether to accept the resignation. The Board’s explanation of its decision will be promptly disclosed in a filing with the Securities and Exchange Commission (“SEC”).

The affirmative vote of shares representing a majority in voting power of the common stock, present in person or represented by proxy at the Annual Meeting, and entitled to vote is necessary for the approval of Proposals 2 and 3.

For Proposal 4, stockholders may vote in favor of holding the vote to approve the compensation paid to the Company’s named executive officers every one year, every two years or every three years and they may also choose to abstain. The option of every one year, every two years or every three years that receives the highest number of votes cast by stockholders will be considered by the Board as the stockholders’ recommendation as to the frequency of future advisory votes on executive compensation.

Proxy cards marked to abstain on Proposals 2 and 3 will have the effect of a negative vote. Proxy cards marked to abstain on Proposal 4 will have no effect on the outcome. Brokernon-votes are not applicable to Proposal 2 because your bank, broker or other nominee will be permitted to use discretion to vote your shares on this proposal. Brokernon-votes will have no impact on Proposals 1, 3 and 3.4.

How can I revoke my proxy or change my vote?

You may revoke your proxy by giving written notice to the Secretary of the Company or by delivering a later dated proxy at any time before it is actually voted. If you voted on the Internet or by telephone, you may change your vote by voting again. Your last vote is the vote that will be counted. Attendance at the Annual Meeting does not revoke your proxy unless you vote at the Annual Meeting.

FREQUENTLY ASKED QUESTIONS (CONTINUED)

Will my vote be public?

As a matter of policy, proxies, ballots and tabulations that identify individual stockholders are not publicly disclosed, but are available to the independent Inspector of Election the proxy solicitation firm and certain employees of the Company.

What constitutes a quorum?

The presence at the Annual Meeting, in person or by proxy, of the holders of a majority in voting power of the issued and outstanding shares of common stock entitled to vote will constitute a quorum. Proxies received but marked as abstentions or without any voting instructions will be included in the calculation of the number of shares considered to be present at the Annual Meeting.

Our Board is soliciting this proxy. The Company will bear the expense of soliciting proxies for this Annual Meeting, including mailing costs. To assureensure that there is sufficient representation at the Annual Meeting, our proxy solicitor or our employees may solicit proxies by telephone, facsimile or in person. We have retained Innisfree M&A Incorporated as our proxy solicitor for a fee, estimated at $15,000, plus reasonableout-of-pocket expenses, to aid in soliciting proxies. Our total expenses will depend upon the volume of shares represented by the proxies received in response to the Notice and Proxy Statement.

FREQUENTLY ASKED QUESTIONS (CONTINUED)

What if I am a participant in the Fortune Brands Home & Security Retirement Savings Plan or the Fortune Brands Home & Security Hourly Employee Retirement Savings Plan?

We are mailing a printed copy ofParticipants who invest in the proxy materials to participants inFortune Brands Stock Fund through the Fortune Brands Home & Security Retirement Savings Plan and the Fortune Brands Home & Security Hourly Employee Retirement Savings Plan (collectively, the “Savings Plans”) who invest in the Fortune Brands Stock Fund through the Savings Plans.were mailed a Notice. The Trustee of the Savings Plans, as record holder of the Fortune Brands common stock held in the Savings Plans, will vote whole shares attributable to your interest in the Fortune Brands Stock Fund in accordance with your directions. If you investFollow the voting instructions provided in the Fortune Brands Stock Fund under the Savings Plans and you sign and return the enclosed proxy card, we will forward itNotice to the Trustee of the Savings Plans. The proxy card will serve as instruction toallow the Trustee to vote the whole shares attributable to your interest in the manner you indicate on the card.accordance with your instructions. If the Trustee does not receive timely directionvoting instructions with respect to the voting of your shares held in the Fortune Brands Stock Fund, the Trustee will vote such shares in the same manner and in the same proportion as the shares for which the Trustee receiveddid receive voting instructions.

How can I eliminate multiple mailings to the same address?

If you and other residents at your mailing address are registered stockholders and you receive more than one copy of the Notice, but you wish to eliminate the duplicate mailings, you must submit a written request to the Company’s transfer agent, Wells Fargo.EQ Shareowner Services. To request the elimination of duplicate copies, please write to Wells FargoEQ Shareowner Services, 1110 Centre Pointe Curve, Suite 101, MACN9173-010,Mendota Heights, Minnesota 55120.

If you and other residents at your mailing address own shares in street name, your broker, bank or other nominee may have sent you a notice that your household will receive only one Notice or one set of proxy materials for each company in which you hold stock through that broker, bank or other nominee. This practice, known as “householding,” is designed to reduce our printing and postage costs. If you did not respond, the bank, broker or other nominee will assume that you have consented, and will send only one copy of the Notice to your address. You may revoke your consent to householding at any time by sending your name, the name of your brokerage firm, and your account number to Broadridge, Householding Department, 51 Mercedes Way, Edgewood, New York 11717. The revocation of your consent to householding will be effective 30 days following its receipt. In any event, if you did not receive an individual copy of the Notice or proxy materials, or if you wish to receive individual copies of the Notice or our proxy materialssuch documents for future meetings, we will send aan individual copy to you if you call Shareholder Services at (847)484-4538, or write to the Secretary of Fortune Brands Home & Security, Inc., 520 Lake Cook Road, Deerfield, Illinois 60015.

FREQUENTLY ASKED QUESTIONS (CONTINUED)

How can I submit a stockholder proposal or nomination next year?

Our Bylaws provide that in order for a stockholder to (i) nominate a candidate for election to our Board at the 20182019 Annual Meeting of Stockholders, or (ii) propose business for consideration at the 20182019 Annual Meeting of Stockholders, written notice containing the information required by the Bylaws must be delivered to the Secretary of the Company no less than 90 days nor more than 120 days before the anniversary of the prior year’s Annual Meeting, that is, after January 2, 20181, 2019 but no later than February 1, 2018January 31, 2019 for the 20182019 Annual Meeting.

Under SEC rules, if a stockholder wishes to submit a proposal for possible inclusion in the Company’s 20182019 proxy statement pursuant to Rule14a-8 of the Securities Exchange Act of 1934, as amended (“Exchange Act”), we must receive it on or before November 14, 2017.2018.

The person presiding at the Annual Meeting is authorized to determine if a proposed matter is properly brought before the Annual Meeting or if a nomination is properly made.

Copies of our Restated Certificate of Incorporation and Bylaws are available upon written request to the Secretary, Fortune Brands Home & Security, Inc., 520 Lake Cook Road, Deerfield, Illinois 60015.

Summary of Qualification of Directors

The Board believes that all directors must possess a considerable amount of education and business management experience (such as experience as a chief executive, chief operating, chief financial officer or other relevant experience).experience. The Board also believes that it is necessary for each of the Company’s directors to possess many qualities and skills. The Board believes that there are certain general requirements which are mandatory for service on the Company’s Board,qualities, while there are other skills and experiences that should be represented on the Board as a whole, but not necessarily by each individual director.

General requirementsqualities for all directors:

Extensive executive leadership experience

Excellent business judgment

High level of integrity and ethics

Original thinking

Strong commitment to the Company’s goal of maximizing stockholder value

Specific experiences, qualifications, and backgrounds to be represented on the Board as a whole:

Financial and/or accounting expertise

Consumer products expertise

Knowledge of international markets

Chief executive officer/chief operating officer/chief financial officer experience

Extensive board experience

Diversity of skill, background and viewpoint

The process used by the Nominating and Corporate Governance Committee in recommending qualified director candidates is described below under Corporate Governance – Director Nomination Process (see page 106 of this Proxy Statement).

Election of Class IIII Directors

The Board consists of eight members and is divided into three classes, each having three year terms that expire in successive years. The term of the Class IIII directors expires at the 20172018 Annual Meeting of Stockholders. The Board has nominated Ms. Ann F. Hackett, Mr. A. D. David Mackay, Mr. David M. ThomasJohn G. Morikis and Mr. Norman H. Wesley,Ronald V. Waters, III, each of whom is currently serving as a Class IIII director, forre-election for a new term of three years expiring at the 20202021 Annual Meeting of Stockholders and until their successors are duly elected and qualified. ProxiesShares cannot be voted for more than the number of nominees proposed forre-election.

Each of the nominees has consented to be named as a nominee and to serve as a director, if elected. If any of them should become unavailable to serve as a director (which is not now expected), the Board may designate a substitute nominee. In that case, the Proxy Committeepersons named in the enclosed proxy card will vote for the substitute nominee designated by the Board.

The names of the nominees and the current Class III and Class IIIII directors, along with their present positions, their principal occupations and employment during the last five years, any directorships held with other public corporationscompanies during the past five years, their ages and the year first elected as a director of the Company, are set forth below. Individual qualifications and experiences of our directors that contribute to the Board’s effectiveness as a whole are also described in the following paragraphs.

PROPOSAL 1 –ELECTIONOF DIRECTORS (CONTINUED)

Name | Present positions and offices with the Company, principal occupations during the past five years and other directorships | Age | Year first elected director | |||||||

| NOMINEES FOR DIRECTOR – CLASS III DIRECTORS – TERM EXPIRING 2020 | ||||||||||

A.D. David Mackay | Retired since January 2011; President and Chief Executive Officer of Kellogg Company, a packaged foods manufacturer, prior thereto. Currently also a director of The Clorox Company. Formerly a director of Keurig Green Mountain, Inc., McGrath Limited, Woolworths Limited, Beam Inc. and Kellogg Company. | 61 | 2011 | |||||||

| Mr. Mackay held various key executive positions with Kellogg Company including Chief Executive Officer and Chief Operating Officer, bringing to our Board the perspective of a leader who faced a similar set of external economic, social and governance issues to those that face our Company. Mr. Mackay also has significant international business experience, as well as extensive board experience. | ||||||||||

David M. Thomas | Retired since March 2006; Chairman of the Board and Chief Executive Officer of IMS Health Incorporated, a provider of information services to the pharmaceutical and healthcare industries, prior thereto. Currently also a director of The Interpublic Group of Companies, Inc. and a member of the Fidelity Investments Board of Trustees. | 67 | 2011 | |||||||

| Mr. Thomas’ experience as a Chief Executive Officer of IMS Health Incorporated and his management experience at premier global technology companies, including as Senior Vice President and Group Executive of IBM, helps the Board address the challenges the Company faces due to rapid changes in IT capabilities and communications and global distribution strategies. Mr. Thomas also has extensive board experience. | ||||||||||

Norman H. Wesley | Retired since October 2008; Chairman of the Board and Chief Executive Officer of Fortune Brands, Inc. prior thereto. Currently also a director of Acuity Brands, Inc. and Achusnet Holdings Corp. Formerly a director of Keurig Green Mountain, Inc. and ACCO Brands, Inc. | 67 | 2011 | |||||||

| Mr. Wesley’s experience as Chief Executive Officer of a consumer products conglomerate gives him unique insights into the Company’s challenges, opportunities and operations. Mr. Wesley also has extensive board experience. | ||||||||||

Name | Present positions and offices with the Company, principal | Age | Year first elected director | |||||||

NOMINEES FOR DIRECTOR – CLASS I DIRECTORS – TERM EXPIRING 2021 |

| |||||||||

Ann F. Hackett | Partner andco-founder of Personal Pathways, LLC, a company providingweb-based enterprise collaboration platforms, since 2015. Prior to that, President of Horizon Consulting Group, LLC, a strategic and human resource consulting firm founded by Ms. Hackett in 1996. Currently also a director of Capital One Financial Corporation. Formerly a director of Beam Inc. | 64 | 2011 | |||||||

Ms. Hackett has extensive experience in leading companies that provide strategic, organizational and human resource consulting services to boards of directors and senior management teams. She has experience leading change initiatives, risk management, talent management and succession planning and in creating performance- based compensation programs, as well as significant international experience and technology experience. Ms. Hackett also has extensive board experience and currently serves as the lead independent director of Capital One Financial Corporation. |

| |||||||||

John G. Morikis | President and Chief Executive Officer since January 2016 and Chairman since January 2017 of The Sherwin-Williams Company, a manufacturer of paint and coatings products. President and Chief Operating Officer from 2006 to January 2016. Currently a director of The Sherwin-Williams Company. | 54 | 2011 | |||||||

| Mr. Morikis’ experience as a Chief Executive Officer and as a Chief Operating Officer of The Sherwin-Williams Company, and his more than 30 years of experience with a consumer home products company, brings to our Board the perspective of a leader who faces similar external economic issues that face our Company. | ||||||||||

Ronald V. Waters, III | Retired since May 2010; President and Chief Executive Officer of LoJack Corporation, a provider of tracking and recovery systems, from January 2009 to May 2010. Currently also a director of HNI Corporation and Paylocity Holding Corporation. Formerly a director of Chiquita Brands International, Inc. | 65 | 2011 | |||||||

| Mr. Waters has considerable executive leadership and financial management experience. He served as Chief Executive Officer and Chief Operating Officer at LoJack Corporation, a premier technology company, and as Chief Operating Officer and Chief Financial Officer at Wm. Wrigley Jr. Company, a leading confectionary manufacturing company. Mr. Waters also has extensive board experience. | ||||||||||

The Board of Directors recommends that you vote FOR the election of each nominee named above.

PROPOSAL ROPOSAL 1 –ELECTIONOF DIRECTORS (CONTINUED)

Name | Present positions and offices with the Company, principal occupations during the past five years and other directorships | Age | Year first elected director | |||||||

| CLASS I DIRECTORS – TERM EXPIRING 2018 | ||||||||||

Ann F. Hackett | Partner andco-founder of Personal Pathways, LLC, a company providingweb-based enterprise collaboration platforms, since 2015. Prior to that, President of Horizon Consulting Group, LLC, a strategic and human resource consulting firm, founded by Ms. Hackett in 1996. Currently also a director of Capital One Financial Corporation. Formerly a director of Beam Inc. | 63 | 2011 | |||||||

| Ms. Hackett has extensive experience in leading companies that provide strategic, organizational and human resource consulting services to boards of directors and senior management teams. She has experience leading change initiatives, risk management, talent management and succession planning and in creating performance-based compensation programs, as well as significant international experience and technology experience. Ms. Hackett also has extensive board experience and currently serves as the lead independent director of Capital One Financial Corporation. | ||||||||||

John G. Morikis | President and Chief Executive Officer of The Sherwin-Williams Company, a manufacturer of paint and coating products, since January 2016 and also Chairman of the Board since January 2017; President and Chief Operating Officer from 2006 to January 2016. Currently a director of The Sherwin-Williams Company. | 53 | 2011 | |||||||

| Mr. Morikis’ experience as a Chief Executive Officer and as a Chief Operating Officer of The Sherwin-Williams Company, and his more than 30 years of experience with a consumer home products company, brings to our Board the perspective of a leader who faces similar external economic issues that face our Company. | ||||||||||

Ronald V. Waters, III | Retired since May 2010; President and Chief Executive Officer of LoJack Corporation, a provider of tracking and recovery systems, from January 2009 to May 2010. Currently also a director of HNI Corporation and Paylocity Holding Corporation. Formerly a director of Chiquita Brands International, Inc. | 64 | 2011 | |||||||

| Mr. Waters has considerable executive leadership and financial management experience. He served as Chief Executive Officer and Chief Operating Officer at LoJack Corporation, a premier technology company, and as Chief Operating Officer and Chief Financial Officer at Wm. Wrigley Jr. Company, a leading confectionary manufacturing company. Mr. Waters also has extensive board experience. | ||||||||||

Name | Present positions and offices with the Company, principal | Age | Year first elected director | |||||||

CLASS II DIRECTORS – TERM EXPIRING 2019 |

| |||||||||

Susan S. Kilsby | Retired since May 2014; Senior Advisor at Credit Suisse AG, an investment banking firm, from 2009 to May 2014; Managing Director of European Mergers and Acquisitions of Credit Suisse prior thereto. Currently also a director of Shire Plc, BBA Aviation PLC and Goldman Sachs International.Formerly a director of Keurig Green Mountain, Inc., and Coca-Cola HBC AG. | 59 | 2015 | |||||||

| Ms. Kilsby has a distinguished global career in investment banking and brings extensive mergers and acquisitions and international business experience to the Board. In addition to her experience at Credit Suisse, she held a variety of senior positions with The First Boston Corporation, Bankers Trust and Barclays de Zoete Wedd. Ms. Kilsby also has extensive board experience and currently serves as thenon-executive Chair of Shire Plc. | ||||||||||

Christopher J. Klein | Chief Executive Officer of the Company since January 2010. President and Chief Operating Officer prior thereto. Currently also a director of Thor Industries, Inc. | 54 | 2010 | |||||||

| Mr. Klein’s leadership as Chief Executive Officer of the Company and his significant corporate strategy, business development and operational experience provide him with intimate knowledge of our operations and the challenges faced by the Company. Mr. Klein led the Company through thespin-off from Fortune Brands, Inc. in 2011. Prior to the Company’sspin-off, he held several leadership positions at Fortune Brands, Inc., helping to reshape the business through acquisitions and divestitures. Prior to joining Fortune Brands, Mr. Klein held key strategy and operating positions at Bank One Corporation and also served as a partner at McKinsey & Company, a global management consulting firm. | ||||||||||

PROPOSAL 1 –ELECTIONOF DIRECTORS (CONTINUED)

Name | Present positions and offices with the Company, principal occupations during the past five years and other directorships | Age | Year first elected director | |||||||

| CLASS II DIRECTORS – TERM EXPIRING 2019 | ||||||||||

Susan S. Kilsby | Retired since May 2014; Senior Advisor at Credit Suisse AG, an investment banking firm, from 2009 to May 2014; Managing Director of European Mergers and Acquisitions of Credit Suisse prior thereto. Currently also a director of Shire Plc, BBA Aviation PLC and Goldman Sachs International. Formerly a director of Keurig Green Mountain, Inc., L’Occitane International S.A. and Coca-Cola HBC AG. | 58 | 2015 | |||||||

| Ms. Kilsby has a distinguished global career in investment banking and brings extensive mergers and acquisitions and international business experience to the Board. In addition to her experience at Credit Suisse, she held a variety of senior positions with The First Boston Corporation, Bankers Trust and Barclays de Zoete Wedd. Ms. Kilsby also has extensive board experience and currently serves as thenon-executive Chair of Shire Plc. | ||||||||||

Christopher J. Klein | Chief Executive Officer of the Company since January 2010. President and Chief Operating Officer prior thereto. | 53 | 2010 | |||||||

| Mr. Klein’s leadership as Chief Executive Officer of the Company and his vast corporate strategy, business development and operational experience provide him with intimate knowledge of our operations and the challenges faced by the Company. Mr. Klein led the Company through thespin-off from Fortune Brands, Inc. in 2011. Prior to the Company’sspin-off, he held several leadership positions at Fortune Brands, Inc., helping to reshape the business through acquisitions and divestitures. Prior to joining Fortune Brands, Mr. Klein held key strategy and operating positions at Bank One Corporation and also served as a partner at McKinsey & Company, a global management consulting firm. | ||||||||||

Name | Present positions and offices with the Company, principal | Age | Year first elected director | |||||||

| ||||||||||

A.D. David Mackay | Retired since January 2011; President and Chief Executive Officer of Kellogg Company, a packaged foods manufacturer, prior thereto. Currently also a director of The Clorox Company. Formerly a director of Keurig Green Mountain, Inc., McGrath Limited, Woolworths Limited and Beam Inc. | 62 | 2011 | |||||||

| Mr. Mackay held various key executive positions with Kellogg Company including Chief Executive Officer and Chief Operating Officer, bringing to our Board the perspective of a leader who faced a similar set of external economic, social and governance issues to those that face our Company. Mr. Mackay also has significant international business experience, as well as extensive board experience. | ||||||||||

David M. Thomas | Retired since March 2006; Chairman of the Board and Chief Executive Officer of IMS Health Incorporated, a provider of information services to the pharmaceutical and healthcare industries, prior thereto. Currently also a director of The Interpublic Group of Companies, Inc. and a member of the Fidelity Investments Board of Trustees. | 68 | 2011 | |||||||

| Mr. Thomas’ experience as a Chief Executive Officer of IMS Health Incorporated and his management experience at premier global technology companies, including as Senior Vice President and Group Executive of IBM, helps the Board address the challenges the Company faces due to rapid changes in IT capabilities and communications and global distribution strategies. Mr. Thomas also has extensive board experience. | ||||||||||

Norman H. Wesley | Retired since October 2008; Chairman of the Board and Chief Executive Officer of Fortune Brands, Inc. prior thereto. Currently also a director of Acuity Brands, Inc. and Acushnet Holdings Corp. Formerly a director of Keurig Green Mountain, Inc. and ACCO Brands Corporation. | 68 | 2011 | |||||||

| Mr. Wesley’s experience as Chief Executive Officer of a consumer products conglomerate gives him unique insights into the Company’s challenges, opportunities and operations. Mr. Wesley also has extensive board experience. | ||||||||||

Fortune Brands is committed to maintaining strong corporate governance practices that are good for our stockholders and our business. We are dedicated to maintaining these practices and upholding high standards of conduct.

Corporate Governance Principles

The Board adopted a set of Corporate Governance Principles which describe our corporate governance practices and address corporate governance issues such as Board composition and responsibilities, Board meeting procedures, the establishment of Board committees, management succession planning process and review of risks. The Corporate Governance Principles are available athttp://ir.fbhs.com/corporate-governance.cfmcorporate-governance.cfm.

The Company’s Corporate Governance Principles provide that a majority of the members of the Board shall be independent directors. New York Stock Exchange requirements, as well as the Company’s committee charters, require that each member of the Audit, Compensation and Nominating and Corporate Governance Committees to be independent. The Board applies the definition of independence found in the New York Stock Exchange Listed Company Manual in determining which directors are independent. When determining each director’s independence, the Board also considered charitable contributions made by the Company to organizations with which each director is affiliated.

Applying that definition, Messrs. Mackay, Morikis, Thomas, Wesley and Waters and Mses.

Hackett and Kilsby were affirmatively determined by the Board to be independent. Due to Mr. Klein’s employment with the Company, he is not considered independent.

None of thenon-employee directors has any material relationship with the Company other than being a director and stockholder. Also, none of thenon-employee directors have participated in any transaction or arrangement that interferes with such director’s independence.

Policies with Respect to Transactions with Related Persons

The Board has adopted a Code of Business Conduct & Ethics which sets forth various policies and procedures intended to promote the ethical behavior of all of the Company’s employees, officers and directors (the “Code of Conduct”). The Code of Conduct describes the Company’s policy on conflicts of interest. The Board has established a Compliance Committee (comprised of management) which is responsible for administering and monitoring compliance with the Code of Conduct. The Compliance Committee periodically reports on the Company’s compliance efforts to the Audit Committee and to the Board.

The Board has also established a Conflicts of Interest Committee (comprised of management) which is responsible for administering, interpreting and applying the Company’s Conflicts of Interest Policy, which describes the types of relationships that may constitute a conflict of interest with the Company. Under the Conflicts of Interest Policy, directors and executive officers are responsible for reporting any potential related person transaction (as defined in Item 404 of RegulationS-K) to the Conflicts of Interest Committee in advance of commencing a potential transaction. The Conflicts of Interest Committee will present to the Audit Committee any potential related party transaction. The Audit Committee will evaluate the transaction, determine whether the interest of the related person is material and approve or ratify, as the case may be, the transaction. In addition, the Company’s executive officers and directors annually complete a questionnaire on which they are required to disclose any related person transactions and potential conflicts of interest. The General Counsel reviews the responses to the questionnaires and, if a related person transaction is reported by a director or executive officer, submits the transaction for review by the Audit Committee. The Conflicts of Interest Committee also reviews potential conflicts of interest and reports findings involving any director of the Company to the Nominating and Corporate Governance Committee (the “Nominating Committee”). The Nominating Committee will review any potential conflict of interest involving a member of the Board to determine whether such potential conflict would affect that director’s independence.

CORPORATE GOVERNANCE (CONTINUED)

Certain Relationships and Related Transactions

Since January 1, 2016,2017, the Company did not participate in any transactions in which any of its directors, executive officers, any immediate family member of a director or executive officer or any beneficial owner of more than 5% of the Company’s common stock had a direct or indirect material interest.

The Nominating Committee is responsible for, among other things, screening potential director candidates, recommending qualified candidates to the Board for nomination and assessing director independence.

When identifying director candidates, the Nominating Committee determines whether there are any evolving needs that require an expert in a particular field or other specific skills or experiences. When evaluating director candidates, the Nominating Committee first considers a candidate’s management experience and then considers issues of judgment, background, stature, conflicts of interest, integrity, ethics and commitment to the goal of maximizing stockholder value. The Nominating Committee also focuses on issues of diversity, such as diversity of gender, race and national origin, education, professional experience and differences in viewpoints and skills. The Nominating Committee does not have a formal policy with respect to diversity; however, the Board and the Nominating Committee believe that it is essential that the Board members represent diverse viewpoints. In considering candidates for the Board, the Nominating Committee considers the entirety of each candidate’s credentials in the context of these standards. With respect to the nomination of continuing directors forre-election, the individual’s contributions to the Board are also considered. For the purpose of this Annual Meeting, the Nominating Committee recommended the nomination of Ms. Hackett and Messrs. Mackay, ThomasMorikis and WesleyWaters as Class IIII directors.

In connection with future director elections, or at any time there is a vacancy on the Board, the Nominating Committee may retain a third-party search firm to assist in locating qualified candidates that meet the needs of the Board at that time.

It is the Nominating Committee’s policy to consider director candidates recommended by stockholders, if such recommendations are properly submitted to the Company. Stockholders that wish to recommend an individual as a director candidate for consideration by the Nominating Committee can do so by writing to the Secretary of Fortune Brands Home & Security, Inc. at 520 Lake Cook Road, Deerfield, Illinois 60015.

Recommendations must include the proposed nominee’s name, biographical data and qualifications, as well as other information that would be required if the stockholder were actually nominating the recommended candidate pursuant to the procedures for such nominations provided in our Bylaws. The Nominating Committee will consider the candidate and the candidate’s qualifications in the same manner in which it evaluates nominees identified by the Nominating Committee. The Nominating Committee may contact the stockholder making the nomination to discuss the qualifications of the candidate and the stockholder’s reasons for making the nomination. Members of the Nominating Committee may then interview the candidate if the committee deems the candidate to be appropriate. The Nominating Committee may use the services of a third-party search firm to provide additional information about the candidate prior to making a recommendation to the Board.

The Nominating Committee’s nomination process is designed to ensure that the Nominating Committee fulfills its responsibility to recommend candidates that are properly qualified to serve the Company for the benefit of all of its stockholders, consistent with the standards established under the Company’s Corporate Governance Principles.

The Board and management encourage communication from the Company’s stockholders. Stockholders who wish to communicate with the Company’s management should direct their communication to the Chief Executive Officer or the Secretary of Fortune Brands Home & Security, Inc. at 520 Lake Cook Road, Deerfield, Illinois 60015. Stockholders, or other interested parties, who wish to communicate with thenon-management

CORPORATE GOVERNANCE (CONTINUED)

Illinois 60015. Stockholders, or other interested parties, who wish to communicate with thenon-managementdirectors or any individual director should direct their communication c/o the Secretary at the address above. The Secretary will forward communications intended for the Board to the Chairman of the Board, or, if intended for an individual director, to that director. If multiple communications are received on a similar topic, the Secretary may, in his or her discretion, forward only representative correspondence. Any communications that are abusive, in bad taste or present safety or security concerns may be handled differently.

Mr. Thomas serves as the Company’snon-executive, independent Chairman. The Board determined that having an independent director serve as Chairman of the Board is in the best interests of our stockholders at this time. This leadership structure aids the Board’s oversight of management and allows our Chief Executive Officer to focus primarily on his management responsibilities. Thenon-executive Chairman has the responsibility of presiding at all meetings of the Board, consulting with the Chief Executive Officer on Board meeting agendas, acting as a liaison between management and thenon-management directors, including maintaining frequent contact with the Chief Executive Officer and advising him or her on the efficiency of the Board meetings, facilitating teamwork and communication between thenon-management directors and management, as well as additional responsibilities that are more fully described in the Company’s Corporate Governance Principles. In addition, the Company’snon-executive Chairman facilitates the Board’s annual performance assessment of the Chief Executive Officer.

The Board does not believe that a single leadership structure is right at all times, so the Board periodically reviews its leadership structure to determine, based on the circumstances at the time, whether other leadership structures might be appropriate for the Company. The Board has been and remains committed to maintaining strong corporate governance and appropriate independent oversight of management. Given that each of the members of the Board, other than Mr. Klein, is independent we believe that the leadership structure currently utilized by the Board provides effective independent Board leadership and oversight.

Pursuant to the Company’s Corporate Governance Principles,non-management directors of the Board are required to meet on a regularly scheduled basis without the presence of management. Thenon-executive Chairman of the Board leads these sessions. In addition, Board Committees also meet regularly in executive session without the presence of management.

The Board of Directors met fivesix times in 2016.2017. Each director attended at leastmore than 75% of the total meetings of the Board and committees of the Board of which the director was a member during 2016.2017. Pursuant to the Company’s Corporate Governance Principles, all directors are encouraged and expected to attend the Annual Meeting. All of the directors attended the Company’s 20162017 Annual Meeting of Stockholders.

The responsibility for theday-to-day management of risks lies with the Company’s management team; however, the Board has an active role, as a whole and also at the committee level, in overseeing the strategy and process for managing the Company’s risks. The Board regularly reviews information regarding the Company’s business strategy, leadership development, resource allocation, succession planning, credit, liquidity and operations, as well as the risks associated with each. The Company’s overall risk management program consists of periodic management discussions analyzing and mitigating risks, an annual review of risks associated with each of the Company’s operating businesses and an annual review of risks related to the Company’s compensation programs and practices.

CORPORATE GOVERNANCE (CONTINUED)

Annually, management identifies both external risks (i.e., economic) and internal risks (i.e., strategic, operational, financial and compliance), assesses the impact of these risks and determines how to mitigate such

CORPORATE GOVERNANCE (CONTINUED)

risks. The Audit Committee manages the Company’s risk management program and reviews the results of the annual assessment. Management also provides the Audit Committee with quarterly updates on the Company’s risks. In addition, the Audit Committee oversees management of the Company’s financial risks.

The Company’s Compensation Committee is responsible for overseeing the management of risks relating to the compensation paid to the Company’s executives and the Company’s executive compensation plans and programs.plans. Annually, the Compensation Committee’s independent compensation consultant conducts an assessment of the risks associated with the Company’s executive compensation practicespolicies and programs.practices. The compensation consultant conducts a more extensive review of all of the Company’s broad-based compensation incentive arrangements every threefew years. For more information about that assessment see “Compensation Risks” below.

The Nominating Committee manages risks associated with the independence of the Board, potential conflicts of interest of Board members, and the Company’s corporate governance structure, as well as management of risks associated with the environment, health and safety, diversity, philanthropy, global citizenship and sustainability.

While each committee is responsible for evaluating certain risks and overseeing the management of such risks, the entire Board is regularly informed through committee reports about all of the risks described above. The Board’s assignment of responsibility for the oversight of specific risks to its committees enables the entire Board, under the leadership of thenon-executive Chairman and the Chief Executive Officer, to better monitor the risks of the Company and more effectively develop strategic direction, taking into account the magnitude of the various risks facing the Company, including the magnitude of such risks.Company.

The Compensation Committee’s compensation consultant conducts an annual assessment of the risks associated with the compensation policies and practices used to compensate the Company’s executives and reports on the assessment to the Compensation Committee. In 2016,2017, the Compensation Committee, with assistance from its independent compensation consultant, reviewed the elements of executive compensation to determine whether any portion of executive compensation encouraged excessive risk taking and concluded that they do not. In general, the executive compensation arrangements are consistent with the structure and design of other companies of similar size and industry sector, and the following risk-mitigating design features have been incorporated into the Company’s programs:

The Company utilizes multiple long-term incentive vehicles with overlapping three year performance cycles;

The Company uses multiple and diverse performance metrics in incentive plans;

The upside on payout potential is capped for both short-term and long-term incentives;

The Company utilizes multiple long-term incentive vehicles, with PSAs that have overlapping three-year performance cycles;

The majority of an individual’s total compensation mix is not derived from a single component of compensation; and

The Company maintains stock ownership guidelines, a policy prohibiting hedging and pledging and a formal clawback policy.

As described in our Compensation Discussion and Analysis, compensation decisions are made using a combination of objective and subjective considerations designed to mitigate excessive risk taking by executives.

CORPORATE GOVERNANCE (CONTINUED)

The Board established an Audit Committee, a Compensation Committee, an Executive Committee and a Nominating and Corporate Governance Committee. A list of current Committee memberships may be found on the Company’s website athttp://ir.fbhs.com/committees.cfmcommittees.cfm. The Committee memberships as of the date of this Proxy Statement are set forth below:

| Name | Audit | Compensation | Executive | Nominating and Corporate Governance | ||||

Ann F. Hackett | C | X | X | |||||

Susan S. Kilsby | X | X | ||||||

Christopher J. Klein | X | |||||||

A. D. David Mackay | X | X | ||||||

John G. Morikis | X | X | ||||||

David M. Thomas | X | C | C | |||||

Ronald V. Waters, III | C | X | X | |||||

Norman H. Wesley | X | X |

An “X” indicates membership on the committee.

A “C” indicates that the director serves as the chair of the committee.

The Audit Committee’s primary function is to assist the Board in overseeing the (i) integrity of the Company’s financial statements, and the financial reporting process;process and the Company’s system of internal controls; (ii) Company’s compliance with legal and regulatory requirements; (iii) independence and qualifications of the Company’s external auditors; and (iv) performance of the Company’s external and internal auditors.auditors; and (v) the Company’s enterprise risk management program.

Each member of the Audit Committee (Messrs. Mackay, Morikis, Thomas, Waters and Wesley), is financially literate. Each of Messrs. Mackay, Thomas, Waters and Wesley has accounting or financial management expertise and is an audit committee financial expert as defined in Item 407(d)(5)(ii) and (iii) of RegulationS-K under the Exchange Act. As required by its charter, each Audit Committee member has also been determined by our Board to be independent as such term is defined in the Exchange Act and the New York Stock Exchange Listed Company Manual. The Audit Committee met eleventen times in 2016.2017.

The Compensation Committee’s primary functions arefunction is to assist the Board in attracting and retaining high quality leadership by (i) developdeveloping and critically reviewreviewing the Company’s executive compensation program design and pay philosophy and practices so that they are aligned with the Company’s business strategy;philosophy; and (ii) setsetting the compensation of the Company’s executive officers, which includes the presidents of the Company’s principal operating companies, in a manner that is consistent with competitive practices and individualCompany, operating company and Companyindividual performance.

As required by its charter, each member of the Compensation Committee (Messrs. Mackay, Morikis and Wesley and Mses. Hackett and Kilsby) has been determined by our Board to be independent as such term is defined in the Exchange Act and the New York Stock Exchange Listed Company Manual and pursuant to SEC regulations.Manual. The Committee has created a Subcommittee comprised of Mses. Hackett and Kilsby and Messrs. Mackay and Morikis that is responsible for approving all performance standards and payments for any pay program intended to qualify as “performance-based compensation” under Section 162(m) of the Internal Revenue Code (the “Code”). The Compensation Committee met five times in 2016.

Compensation Committee Interlocks and Insider Participation

Since January 1, 2016, none of the members of the Compensation Committee (i) served as one of the Company’s officers or employees; or (ii) had a relationship requiring disclosure under Item 404 of RegulationS-K.2017.

CORPORATE GOVERNANCE (CONTINUED)

Compensation Committee Interlocks and Insider Participation

None of the members of the Compensation Committee has (i) served as one of the Company’s officers or employees, or (ii) had a relationship requiring disclosure under Item 404 of RegulationS-K.

Compensation Committee Procedures

The Compensation Committee directs management to prepare financial data to be used by the Compensation Committee in determining executive compensation. In addition, members of the Company’s human resources department assist in the preparation of executive compensation tally sheets and historical information describing compensation paid to executives, program design and plan provisions and the Compensation Committee’s independent consultant provides market data for use in determining executive compensation. The Compensation Committee is presented with recommendations from management and from the Committee’s independent compensation consultant as to the level and type of compensation to provide to the Company’s executive officers. Members of the Company’s legal department provide the Compensation Committee with general advice on laws applicable to executive compensation and the directors’ fiduciary duties in setting compensation.

The Chief Executive Officer attends meetings of the Compensation Committee.Committee, except for portions of meetings where his performance or compensation is being discussed. The Chief Executive Officer’s feedback about each officer’s performance is essential in the Compensation Committee’s determination of the officer’s salary, target annual incentive and target incentivelong-term equity compensation determinations. See pages 18 through 3319-32 of this Proxy Statement for more information about how the Compensation Committee determined the executive officers’ compensation in 2016.2017.

Compensation Committee Consultant

The Compensation Committee engages an outside compensation consultant. Meridian Compensation Partners, LLC (“Meridian”) was retained directly by and reports directly to the Compensation Committee. In 2016,2017, Meridian provided the following services and information to the Compensation Committee:

Made recommendations as to best practices for structuring executive pay arrangements and executive compensation (including the amount and form of compensation) consistent with the Company’s business needs, pay philosophy, market trends and latest legal, regulatory and regulatorygovernance considerations;

Performed an assessment of the Company’s compensation peers and recommended changes;peers;

Provided market data (including compiling compensation data and related performance data) as background for decisions regarding the compensation of the Chief Executive Officer and other executive officers;

Performed an assessment of risks associated with the Company’s executive compensation structure and design; and

Attended Compensation Committee meetings (including executive sessions without the presence of management) and summarized alternatives for compensation arrangements that may have been considered in formulating final recommendations, as well as the consultant’s rationale for supporting or opposing management’s proposals.

The Compensation Committee has authorized Meridian to interact with management in connection with advising the Compensation Committee. Meridian is included in discussions with management on matters being brought to the Compensation Committee for consideration. Meridian is prohibited from performing any services for management outside of services needed in connection with advising the Compensation Committee.and Nominating Committees. The Compensation Committee has assessed Meridian’s independence and concluded that Meridian’s work for the Compensation Committee does not raise any conflict of interest.

CORPORATE GOVERNANCE (CONTINUED)

The Executive Committee did not meet in 2016.2017. The Executive Committee has all the authority of the full Board, except for specific powers that are required by law to be exercised by the full Board. The Executive Committee may not amend the Company’s charter, adopt an agreement of merger, recommend actions for stockholder approval, amend or repeal the Bylaws, elect or appoint any director or remove an officer or director, amend or repeal any resolutions of the Board, fix the Board’s compensation, and unless expressly authorized by the Board, declare a dividend, authorize the issuance of stock or adopt a certificate of merger.

CORPORATE GOVERNANCE (CONTINUED)

Nominating and Corporate Governance Committee

The Nominating Committee’s primary functions are to (i) provide recommendations to the Board with respect to the organization and function of the Board and its committees; (ii) recruit, identify and recommend potential director candidates and nominees; (iii) review the qualifications and independence of directors and provide recommendations to the Board regarding composition of the committees; (iv) develop a set ofand recommend changes to the Company’s corporate governance framework including the Company’s corporate governance principles; (iv)(v) oversee the process of the evaluation of the Board and management; and (v)(vi) review and advise management on matters relating to the Company’s responsibilities to its employees and the community. The Nominating Committee also makes recommendations to the Board regarding the level and composition of compensation fornon-employee directors and grants annual equity awards to non-employee directors.

As required by its charter, each member of the Nominating Committee (Messrs. Thomas and Waters and Mses. Hackett and Kilsby) has been determined by our Board to be independent as such term is defined in the Exchange Act and the New York Stock Exchange Listed Company Manual. The Nominating Committee met four times in 2016.2017.

Other Corporate Governance Resources

The Company’s Corporate Governance Principles, the Company’s Code of Business Conduct and Ethics and the Company’s Code of Ethics for Senior Financial Officers are available on the Company’s website athttp://ir.fbhs.com/corporate-governance.cfm. The charters of each committee are also available on the Company’s website athttp://ir.fbhs.com/committees.cfm.

In 2016,Fortune Brands is committed to attracting and retaining qualified and experienced directors that contribute to the Nominating Committee reviewed an analysisBoard’s effectiveness and the Company’s goal of outsidemaximizing stockholder value. To accomplish this, the Company maintains anon-employee director compensation prepared by Meridian. After reviewing the analysis, the Nominating Committee recommendedprogram that consists of cash fees and Company stock. During 2017, the Board approved an increase indid not make any changes to the structure of or the amounts provided under thenon-employee director annual cash fees from $80,000 to $90,000 and an increase in the valuecompensation program. Below is a description of the annual stock grant from $115,000 to $135,000. In addition, the Nominating Committee amended the Director Stock Ownership Guidelines to increase the multiple of the ownership requirement from 3 to 5 times the annual cash fee.non-employee director compensation program.

Beginning in July 2016,In 2017, the annual cash fee for services as anon-employee director of the Company was increased from $80,000 to $90,000. The members of the Audit Committee (Messrs. Mackay, Morikis, Thomas, Waters and Wesley) and the Compensation Committee (Mses. Hackett and Kilsby and Messrs. Mackay, Morikis and Wesley) receivereceived an additional annual cash fee of $7,500 for their service on each of these committees. In addition, the chairperson of each of the Audit, Compensation and Nominating Committees receivesreceived an additional annual cash fee of $15,000 for such service (Mr. Waters, Ms. Hackett and Mr. Thomas, respectively). Mr. Thomas receivesreceived an additional annual cash fee of $200,000 for his service asnon-executive Chairman of the Board. Directors may elect to receive payment of their cash fees in Company common stock rather than cash.

In April 2016,May 2017, eachnon-employee director received an annual stock grant that was based on a set dollar value of $135,000. The number of shares granted was determined by dividing the dollar value of the annual stock grant ($135,000) by the closing price of the Company’s common stock on the grant date ($57.37)63.32), rounded to the nearest share. Accordingly, 2,3532,132 shares of Company common stock were granted to each of the then-servingnon-employee directors. Directors may elect to defer receipt of their annual stock awards until the January following the year in which the individual ceases serving as a director of the Company.

Director Stock Ownership Guidelines

To further align the Board’s interests with those of stockholders, the Board establishedmaintains Stock Ownership Guidelines fornon-employee directors. In 2016, theThe guidelines were amended to encouragenon-employee directors to own Company common stock with a fair market value equal to five times their annual cash fee ($450,000 based on the annual fee of currently set at $90,000). The guidelines allow directors five years from the date of the director’s election to the Board to meet the guidelines. Directors with less than one year of service at the time of the increase of the multiple were given five years from the date of the amendment to meet the increased guidelines. All of our directors other than Ms. Kilsby, currently meet the multiple or fall within the five year time period allowed to meet the multiple under the Stock Ownership Guidelines. Ms. Kilsby has five years from the date of the amendment to meet the guidelines. For information about the beneficial ownership of the Company’s securities held by directors and executive officers, see “Certain Information Regarding Security Holdings” on pages 46 and 47.48-49.

Anti-Hedging and Anti-Pledging

The Company has a policy prohibiting directors (as well as senior management) from hedging the risk of owning Company common stock and from pledging or otherwise encumbering shares of Company common stock as collateral for indebtedness in any manner including, but not limited to, holding shares in a margin account.

DIRECTOR COMPENSATION (CONTINUED)

* Although Mr. Klein currently serves as a member of the Board, he does not receive any additional compensation for such service.

| (1) | Mr. Morikis elected to convert the cash fees he earned during the fourth quarter of 2017 to Company common stock pursuant to theNon-Employee Director Stock Election Program. |

| (2) | The amounts in this column represent the aggregate grant date fair value computed in accordance with Financial Accounting Standards Board Accounting Standards Codification Topic 718, Compensation — Stock Compensation (“FASB ASC Topic 718”). The grant date fair value was |

| Included in this column are premiums paid for group life insurance coverage and the Company’s match on gifts paid by the director to charitable organizations, both of which are generally available to Company employees, |

This Compensation Discussion and Analysis (“CD&A”) describes the Company’s executive compensation program and explains how the Compensation Committee made compensation decisions for the following Named Executive Officers (the “NEOs”) in 2016:2017:

Named Executive Officer | Position with the Company During | |

| Christopher J. Klein | Chief Executive Officer, Fortune Brands | |

| Senior Vice President and Chief Financial Officer, Fortune Brands | ||

| David M. Randich | President, MasterBrand Cabinets (“MBCI”) | |

| Nicholas I. Fink | President, Global Plumbing Group | |

| Robert K. Biggart | Senior Vice President, General Counsel and Secretary, Fortune Brands | |

| E. Lee Wyatt, Jr.* | Executive Vice President, Fortune Brands |

| * | Mr. Wyatt retired from the Company on December 31, 2017. He is included as an additional NEO because he served as the Company’s Chief Financial Officer through June 2017. Effective July 1, 2017, Mr. Hallinan assumed the role of the Company’s Chief Financial Officer. |

This CD&A is divided into the following main sections:

an Executive Summary;

the Results of the 20162017Say-on-Pay Vote;

a discussion of the Compensation Committee’s Philosophy and Process for Awarding NEO Compensation; and

a description of the Types and Amounts of NEO Compensation Awarded in 2016.2017.

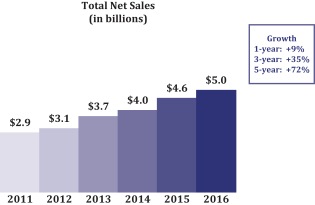

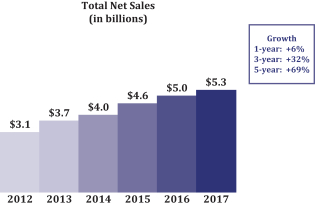

20162017 Business & Financial Highlights1

DeliveredIn 2017, we drove profitable growth and delivered increases on multiple key financial and efficiency measures in 2016 versus the prior year.measures. The measures marked with an * below are those that were linked to 20162017 executive compensation.

Net Sales increased 9%6% to $5.0$5.3 billion

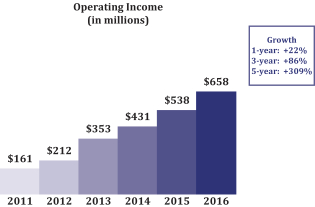

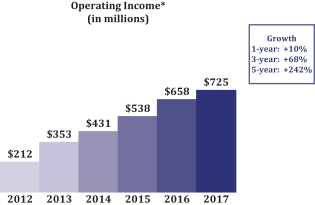

Operating Income (OI*) increased 22%10% to $657.8$725 million

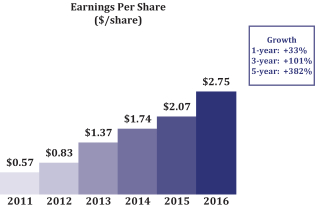

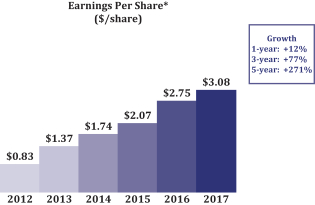

Earnings per share (EPS*) increased 33%12% to $2.75$3.08

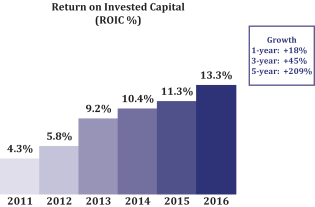

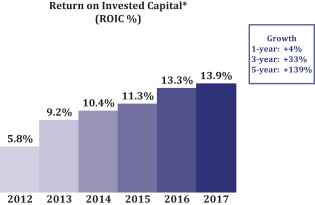

Return on Invested Capital (ROIC*) increased 200 basis points4% to 13.3%13.9%

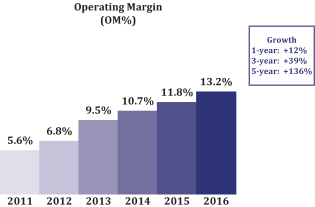

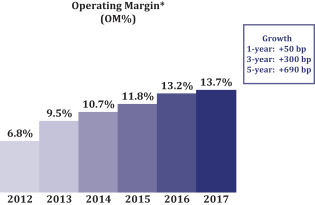

Operating Margin (OM*) increased 14050 basis points to 13.2%13.7%

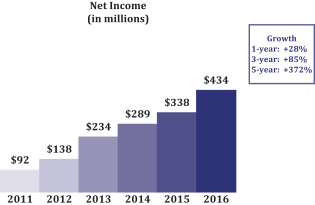

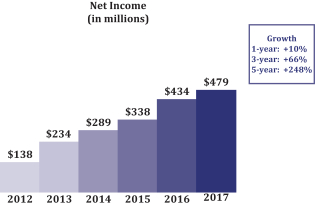

Net Income (NI) increased 28%10% to $434$479 million

Created the Global Plumbing Group (GPG), a new structure that paves the way for additionalGPG continued to drive growth through acquisitions, and joint ventures supported by our global supply chain and strong distribution.expanding its portfolio of brands

Completed the first two acquisitions under GPG by purchasing Riobel,purchase of Shaws of England, a UK premium Canadian showroom brandsink company, and ROHL,Victoria + Albert, a California-based luxury brand.UK premium free-standing bath tub company.

Joined the S&P 500 Index in June 2016.

The following charts show how Fortune Brands grew total shareholder return (TSR), net sales, operating income, earnings per share, return on invested capital, operating margin and net income in 2016. The Company has delivered substantial growth in these metrics since becoming an independent company in 2011. The Compensation Committee believes that the compensation earned by the NEOs in 2016 reflected the Company’s strong financial performance and continued execution against many of the metrics tied to increased shareholder value.

| 1 | All data presented in this CD&A is from continuing operations and all references to OI, EPS, ROIC, |

COMPENSATION DISCUSSIONAND ANALYSIS (CONTINUED)

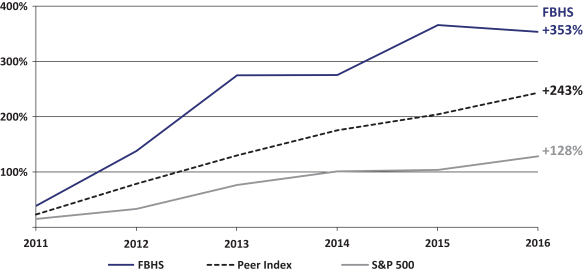

TOTAL SHAREHOLDER RETURN

(TSR %)

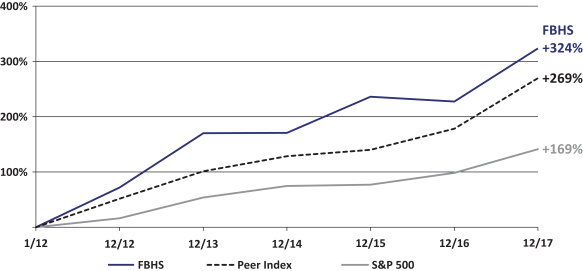

The chart abovebelow shows how Fortune Brands grew total shareholder return (TSR) and reflects the Company’s long-term stock price performance vs. publicly-traded companies in the Company’s 2017 Peer Group2 (see a list on page 23)24 for more information) since the Company’sspin-off from Fortune Brands, Inc. in 2011.

Total shareholder return (TSR)beginning of 2012. TSR has consistently exceeded relevant peerthe Company’s Peer Group and S&P 500 index performance over the long-term.

(TSR %)

The following charts show how the Company has delivered substantial growth in Net Sales, OI, EPS, ROIC, OM and NI since 2012. The compensation earned by the NEOs in 2017 reflected the Company’s strong financial performance in 2017 and continued execution against many of the metrics that the Compensation Committee believes are tied to increased shareholder value.

| 2 | Chart data from Bloomberg. |

COMPENSATION DISCUSSIONAND ANALYSIS (CONTINUED)

|   |

|   |

|   |

COMPENSATION DISCUSSIONAND ANALYSIS (CONTINUED)

20162017 Compensation Highlights3

We use our compensation program to attract, motivate and retain the executives who lead our Company. The Compensation Committee has established programs and practices that are designed to pay for performance and to align management’s interests with those of the Company’s stockholders. We believe that our compensation program helps drive Company performance by providing a significant amount of compensation in the form of equity, by utilizing both short-term and long-term incentives that are tied to Company performance, and by making efforts to balance fixed (base salary) and variable (annual cash and equity incentives)equity) compensation. The 2016 executive compensation program was guided by the following principles:

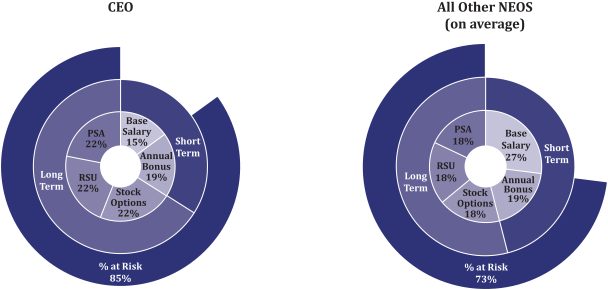

Equity-based compensation aligns executives’ interests with stockholders, drives performance and facilitates retention of superior talent. We believe that equity-based compensation aligns the executives’ interests with those of our stockholders. In 2016, the annual equity grant made up 66% of Mr. Klein’s annual total target compensation and 54% (on average) of the other NEOs’ annual total target compensation. The Compensation Committee approved the following equity-based compensation, as part of the 2016 annual equity grants:

Annual equity awards consisted of performance share awards (PSAs), restricted stock units (RSUs) and stock options.

PSAs will be settled in Company stock only if the performance goals set for the cumulative three- year performance period are met. In 2016, the goals were based on EPS (weighted 75%) and ROIC (weighted 25%) for the period January 1, 2016 through December 31, 2018;

The RSUs granted in 2016 are time-vested awards that will be settled in Company stock, in three equal annual installments, assuming the NEO remains employed through each vesting date; and

Stock options allow the NEOs to purchase Company stock at the market price set on the grant date. The stock options granted in 2016 will vest in three equal annual installments, assuming the NEO remains employed through each vesting date, and expire ten years from the grant date.

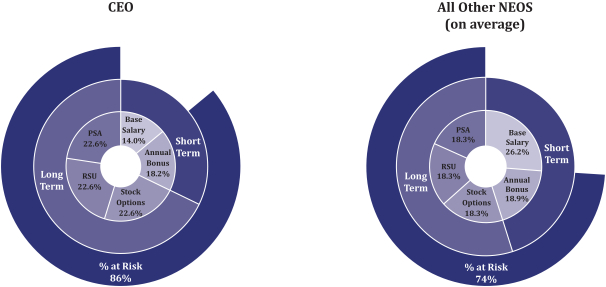

Incentive compensation drives increasing profits and returns. The Compensation Committee continues to believe that linking compensation to certain performance metrics results in increased profits and stronger returns, which supports improving stockholder returns. The 2017 executive compensation program was guided by the following principles:

Equity-based compensation aligns executives’ interests with stockholders, drives performance and facilitates retention of superior talent.

In 2017, the annual equity grants represented 68% of Mr. Klein’s annual total target compensation and 55% (on average) of the other NEOs’ annual total target compensation.

In 2017, annual equity awards for NEOs consisted of performance share awards (PSAs), restricted stock units (RSUs) and stock options:

PSAs will settle in Company stock only if the minimum performance goals set for the cumulative three-year performance period are exceeded;

RSUs will settle in Company stock, in three equal annual installments, assuming the NEO remains employed through each vesting date; and

Stock options allow the NEO to purchase Company stock at the market price set on the grant date, vest in three equal annual installments, assuming the NEO remains employed through each vesting date, and expire ten years from the grant date.

Equity and Incentive compensation linked to increasing profits and returns.

The vast majority of compensation awarded to NEOs ispay-at-risk, or variable dependent upon Company performance. In 2016,2017, 86% of Mr. Klein’s annual total target compensation and 74% (on average) of the Compensation Committee modified the goals used for determiningother NEOs’ annual incentive awards and set challenging performance goals in connection with the annual incentive awards and PSAs:total target compensation waspay-at-risk.

2017-2019 PSAs are based on EBITDA (weighted 75%) and RONTA (weighted 25%) for the January 1, 2017 through December 31, 2019 performance period.